Calculating your monthly or yearly manufacturing overhead can help you improve your company’s financial plan and find ways to budget for such expenses. Companies with effective strategies to calculate and plan for manufacturing overhead costs tend to be more prepared for business emergencies than businesses that never consider overhead expenses. Accurately calculating your company’s manufacturing overhead costs is important for budgeting. Including only direct or “operational” expenses in your financial plan can leave the company in a major cash crunch, as every business in every industry has to incur some overhead costs.

Rigging Machine

These costs fluctuate based on the volume of goods produced, as opposed to remaining fixed regardless of output levels. Recall from Figure 10.1 that the variable overhead standard ratefor Jerry’s is $5 per direct labor hour and the standard directlabor hours is 0.10 per unit. Figure 10.8 shows how to calculatethe variable overhead spending and efficiency variances given theactual results and standards information. Review this figurecarefully before moving on to the next section where thesecalculations are explained in detail. Manufacturing overhead is referred to as indirect costs because it’s hard to trace them to the product.

Mastering Manufacturing Overhead: Keys to Cost Control and Profitability

This is the formula to calculate applied manufacturing overhead in manufacturing. Variable overhead, as alluded to earlier, fluctuates according to levels of production. For companies to operate continuously, they need to spend money on producing and selling their goods and services.

Example of Variable Overhead

Also, if a building must be expanded or the rental of a new production facility is needed to meet increased sales, fixed overhead costs would need to increase to keep the company running smoothly. Employee training and involvement are equally important in managing these costs. A well-trained workforce is more efficient, which can lead to a reduction in indirect labor hours required for production. Encouraging a culture of cost-awareness among employees can lead to more mindful use of resources and proactive identification of cost-saving opportunities. Variable manufacturing overhead represents a critical aspect of production costs, one that fluctuates with changes in output levels.

The variable overhead concept can also be applied to the administrative side of a business. If so, it refers to those administrative costs that vary with the level of business activity. Since most administrative costs are considered to be fixed, the amount of administrative variable overhead is 3 ways to write a receipt usually considered to be so small as to not be worth reporting separately. First, identify the manufacturing expenses in your business for a given period. When you do this calculation and find that the manufacturing overhead rate is low, that means you’re running your business efficiently.

- Use it to centralize manufacturing processes and collaborate with your team so you know how much you’re spending during production.

- Variable production overheads include costs that cannot be directly attributed to a specific unit of output.

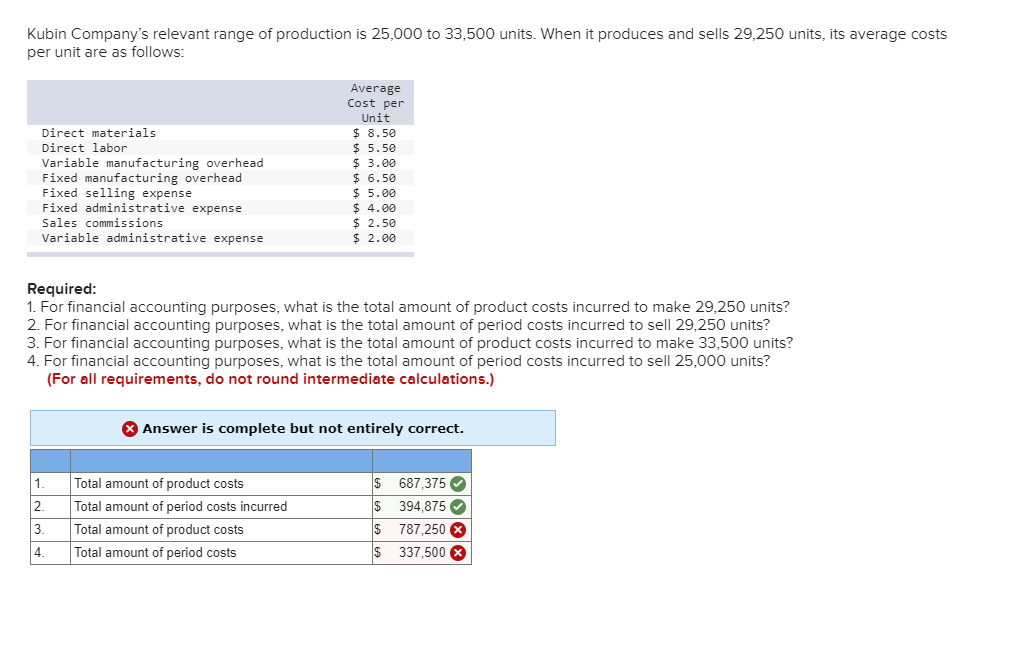

- Kelvin Corporation produces 10,000 digital thermometers per month, and its total variable overhead is $20,000, or $2.00 per unit.

- Most manufacturing overhead budgets cover a year, but each of these values are calculated quarterly.

- For example, if variable overhead costs are typically $300 when the company produces 100 units, the standard variable overhead rate is $3 per unit.

For example, DEF Toy is a toy manufacturer and has total variable overhead costs of $15,000 when the company produces 10,000 units per month. In the following month, the company receives a large order whereby it must produce 20,000 toys. At $1.50 per unit, the total variable overhead costs increased to $30,000 for the month.

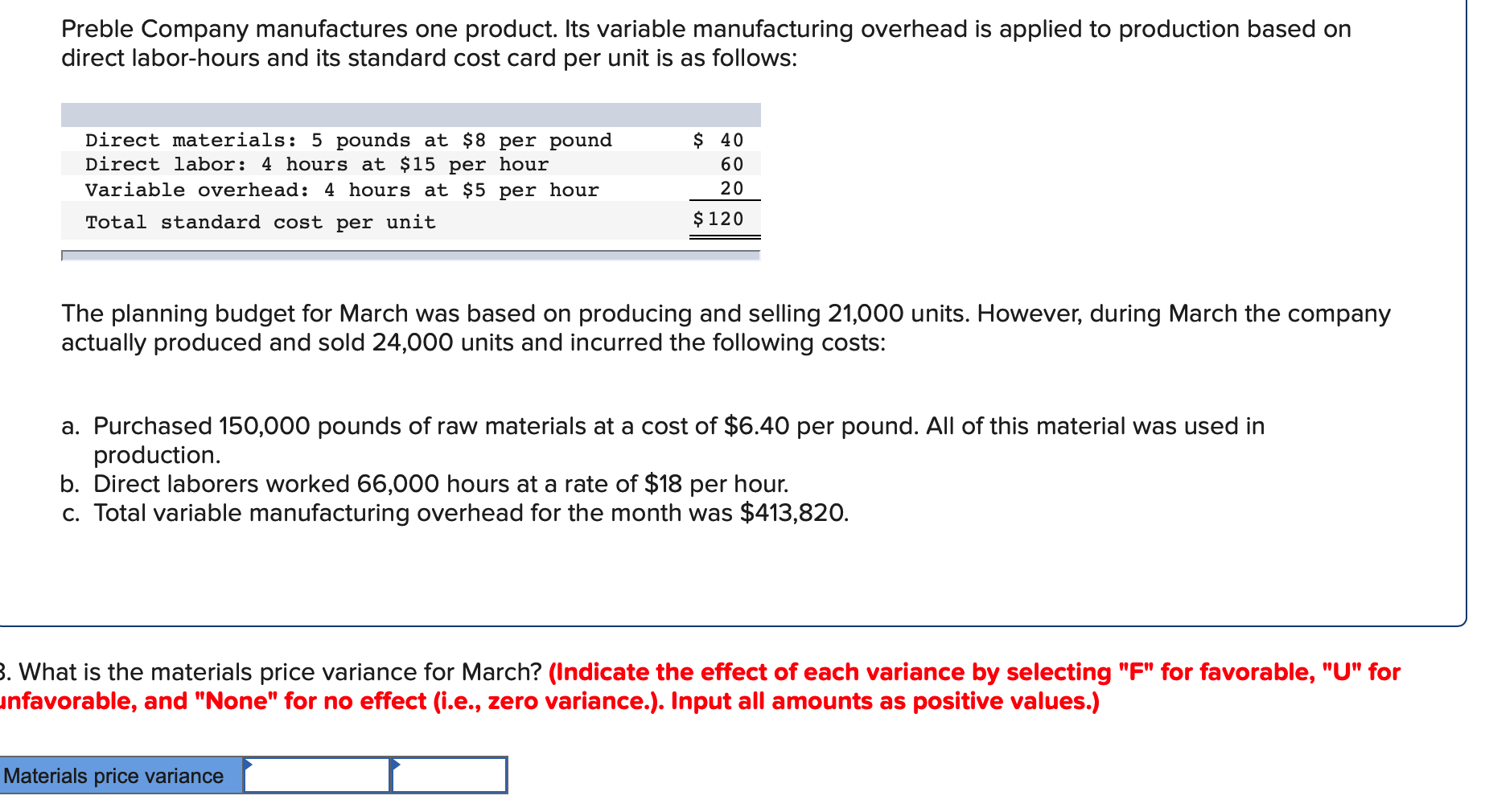

The predetermined overhead rate is an estimation of overhead costs applicable to “work in progress” inventory during the accounting period. This is calculated by dividing the estimated manufacturing overhead costs by the allocation base, or estimated volume of production in terms of labor hours, labor cost, machine hours, or materials. For example, the number of labor hours taken to manufacture a certain amount of product may differ significantly from the standard or budgeted number of hours. Variable overhead efficiency variance is one of the two components of total variable overhead variance, the other being variable overhead spending variance. The difference between actual and standard overhead is referred to as a variance.

The accountant then multiplies the rate by expected production for the period to calculate estimated variable overhead expense. If the business plans to produce 200 units in the next period and the standard rate is $3 per unit, the estimated variable expense is $600. As with direct materials and direct labor variances, allpositive variances are unfavorable, and all negative variances arefavorable. Note that there is no alternative calculation for thevariable overhead spending variance because variable overhead costsare not purchased per direct labor hour. The variable overhead efficiency variance is the difference between the actual and budgeted hours worked, which are then applied to the standard variable overhead rate per hour. It is entirely possible that an improperly-set standard number of labor hours can result in a variance that does not represent the actual performance of an entity.